My Ownership Credits It pays to be a Member

Ownership Credits - Your Equity in Benton REA

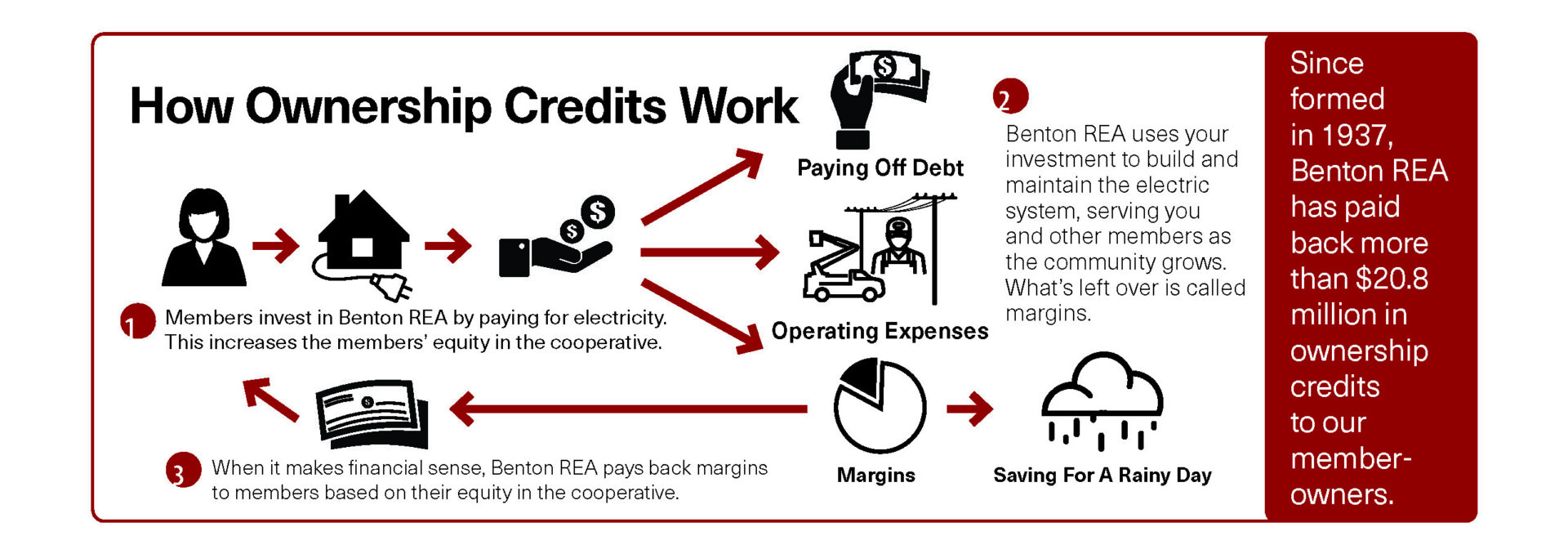

All utilities have margins, but only electric cooperatives, like Benton REA, allocate and, over time, pay back those margins to its members.

Since formed in 1937, Benton REA has paid more than $20.8 million in ownership credits back to its member-owners.

You are a Member and an Owner of Benton REA

By purchasing electricity from Benton REA, you became a member and an owner of the cooperative. So, what does this mean?

Being an owner of an electric cooperative does not mean you own poles, wire and transformers. Your ownership is reflected in other ways, such as your vote. Members vote on important issues and who from the membership will represent them on the Benton REA Board of Trustees. As a member and an owner, you also can become a Trustee if you wish to represent your district and are elected by the members within it.

The other way your ownership is reflected is in your capital (ownership) credits, which are your equity share of Benton REA.

Choose How You Get Paid

To change how you get paid, call 509-786-2913 or return the Ownership Credits Payment Authorization form to a Benton REA office.

Common Ownership Credits Questions:

As a Member-Owner, What Do I Own?

Being an owner of an electric cooperative does not mean you own poles, wire and transformers. Your ownership is reflected in other ways, such as your vote. Members vote on important issues and who from the membership will represent them on the board of trustees.

Your ownership is also reflected is in your capital credits, but because it represents your ownership in Benton REA, we refer to them as ownership credits. They are your equity share in Benton REA.

What Are Ownership Credits?

Ownership credits are a unique benefit of belonging to a cooperative. All utilities have margins, but only electric cooperatives like Benton REA allocate and, over time, pay back those margins to its members.

Benton REA operates at-cost by annually allocating margins to each member based upon their purchase of electricity. Allocation of margins is called ownership credits, which reflect each member’s ownership in and contribution of capital to Benton REA.

If the co-op has margins in the year you purchased electricity from Benton REA, your equity increases. Likewise, the ownership credit payments you receive decrease your equity by the amount of your check.

Benton REA determines your payment amount based on your total accrued ownership credits through the percentage of equity method. Additionally, the board has the authority to pay back one or more of the oldest years’ equity to members.

How Are Margins Allocated to Members?

Each member’s ownership credits are allocated based on the amount of electricity they purchased from the co-op during the year.

How are Ownership Credits Paid?

Benton REA determines your payment based on total accrued ownership credits through the percentage of equity method. Additionally, the board can pay back one or more of the oldest years' equity.

In 2021, $715,750 was paid based on percentage of equity. An additional

$1,038,872.78 fully paid ownership credits from the years 1992 and 1993.

Why Doesn't My Allocation Amount Match my Payment in the Same Year?

If you purchased electricity from Benton REA last year, you will see a portion of the co-op's margins in your allocation statement this year. Allocations are based on the previous year's margins.

This year's payments are based on the total ownership credits the board chooses to retire (pay back). This is why the amount each member is allocated does not match the amount they receive in payments in the same year.

What Is the Percentage of Equity Method?

Each member’s total ownership credits from past years are divided by the total allocation of all members to determine each member's percentage of equity. Each member’s allocation is a percentage of the total allocation, or total equity, of all members of the cooperative. That percentage of equity is the amount that has been authorized by the board of trustees for payment (retirement).

When ownership credits are paid back, each member’s percentage of equity is multiplied by the total dollar amount the board of trustees authorizes to retire (pay back).

Where Does The Money Come From?

The price of the electricity we sell contains a margin in addition to the cost of the product. Unlike for-profit businesses, cooperatives do not keep profit margins. Instead, we keep track of the margins each member contributes. When the financial condition of Benton REA warrants it, the Board of Trustees authorizes Benton REA staff to issue payments of some or all of the margins members have contributed by purchasing electricity.

How Often Do Members Receive Ownership Credit Payments?

The annual decision to pay ownership credits rests solely with your board of trustees and is dependent on the financial condition of the cooperative and the provision of its bylaws.

How Can I Receive My Payment?

Members have four options to receive ownership credit payments:

- Apply it to your primary active Benton REA electric account. This payment will appear as a credit on your Benton REA electric billing statement.

- Donate it to Benton REA’s Power to Care bill assistance program. Power to Care helps qualifying low-income members pay their past-due electric bills.

- Donate it to the Benton REA Education Fund. The Education Fund provides scholarships to local graduating high school seniors as well as pays for the Youth Tour to Washington, D.C., electrical safety demonstrations and member education resources and classes.

- Receive a check in the mail. This is the default option. If your payment is less than $10, it is held in your account until the total is at least $10. Due to the expense of printed checks, $10 is the minimum amount issued to members. Payments less than $10 are accumulated year-to-year until the sum is equal to or greater than $10.

What Happens If I Move?

If you no longer have electric service with Benton REA, please give us your new address so future payments can be mailed to you. You are entitled to your previously allocated ownership credits even if you move away.

I'm 65 or older and am an inactive member. How do I request early ownership credit retirement?

If you no longer receive electric service from Benton REA and you are 65 or older, you can request early ownership retirement at a discount. If you qualify, contact Benton REA by calling 509-781-6724 to complete the early retirement form.

If I die, who gets my unpaid ownership credits?

Ownership credits of the deceased go to their estate. Executers of the estate may request an early discounted ownership credit retirement by calling 509-781-6724.

For more information about ownership credits, contact Benton REA at 509-786-2913.

7 COOPERATIVE PRINCIPLES:

Open and Voluntary Membership

Membership in a cooperative is open to all persons who can reasonably use its services and stand willing to accept the responsibilities of membership, regardless of race, religion, gender, or economic circumstances.

Democratic Member Control

Cooperatives are democratic organizations controlled by their members, who actively participate in setting policies and making decisions. Trustees are elected from among the membership and are accountable to the membership. In primary cooperatives, members have equal voting rights (one member, one vote); cooperatives at other levels are organized in a democratic manner.

Members’ Economic Participation

Members contribute equitably to, and democratically control, the capital of their cooperative. At least part of that capital remains the common property of the cooperative. Members allocate surpluses for any or all of the following purposes: developing the cooperative; setting up reserves; benefiting members in proportion to their transactions with the cooperative; and supporting other activities approved by the membership.

Autonomy and Independence

Cooperatives are autonomous, self-help organizations controlled by their members. If they enter into agreements with other organizations, including governments, or raise capital from external sources, they do so on terms that ensure democratic control as well as their unique identity.

Education, Training, and Information

Education and training for members, elected representatives, CEOs and employees help them effectively contribute to the development of their cooperatives. Communications about the nature and benefits of cooperatives, particularly with the general public and opinion leaders, helps boost cooperative understanding.

Cooperation Among Cooperatives

By working together through local, national, regions and international structures, cooperatives improve services, bolster local economies, and deal more effectively with social and community needs.

Concern for Community

Cooperatives work for the sustainable development of their communities through policies supported by the membership.